Note: I am NOT a financial expert, so we don’t guarantee any earnings. There is certainly risk and a possibility to lose money. Always use your best judgement with anything financially.

“I don’t always like finances and investments, but when I do, I like automating investing,” said in the Dos Equis man’s voice.

We all know that investing in your future and putting away savings for a rainy day is what we’re suppose to do. But, are you?

There are a million reasons why you probably aren’t and I’ve had them all, too. I struggled big time for years because of one simple reason. I never thought it was a perfect time to save money and invest.

After chatting with many people about this, I quickly realized that almost everyone has this same issue unless you’re a financial unicorn.

It hasn’t been more than a couple of years since I started thinking a bit long-term when it came to my business and personal savings accounts and investments.

About two years ago I was sitting down with our CPA and he said, “Hey, what happens if you owe a chunk of money for taxes… do you have any immediate means to pay it?”

He knew that I didn’t have a finance background and only thought about growing my business, not thinking of how I can leverage systems and automation to grow my savings and wealth long-term.

It’s funny because I’m really good at systems in my business, but when it came to the money side of things and wealth, I was clueless.

He challenged me to set up a weekly automated bank transfer of $100 from my main business checking to my savings account. It didn’t seem like much, so I took him up on it. Little did I know, this would soon lead me down the wormhole of investing and wealth building.

I’d soon get obsessed…

Currently, between business and personal accounts, I have five separate savings accounts, two retirement accounts, and two investment accounts… all completely automated.

The retirement accounts are currently earning 16.1%. So, not too shabby, but it’s a long-term game.

Let’s take a step back for a second, so stay with me. I know that finances aren’t the most entertaining topic for many folks, but these seven bloggers do a pretty solid job educating their audience about investing and alternative ways to make money.

This was stale as hell to me until I figured out how to automate it all. Now I find absolute bliss to know that money is constantly being funneled to diversified places, earning me compound interest (Warren Buffett’s best friend that made him a billionaire) and all without me feeling any pinch to my “budget”.

Ask yourself this: Do I want to work until I’m 90 years old? Or, do I want to work now, save a little money consistently and invest so that I can retire many years earlier and take advantage of systems to make myself wealthy?

I’ll take the latter.

Table of Contents

ToggleThe keys to automated investing are as follows:

- Save a percentage of your earnings for your savings and investing (it doesn’t matter how much money you make, anyone can do this). Starting at saving 10% is great, but if you can only do 5%, then start there and move up later.

- Setup automated systems to save and invest on a daily/weekly basis (this spreads out the money so you never feel a pinch of not having enough money to go around).

- Leverage compound interest and smart investments to fund retirement and other life goals (index funds are some of the cheapest and best performing options here).

- Start as soon as possible and repeat for as long as possible!

So, why is this so powerful? With a savings account, you’ll be able to cover those nasty surprise bills with ease, you’ll create a ‘you' savings that you can splurge with from time to time, and you’ll be able to “retire” with potentially millions of dollars in hand, unlike most of the world’s population.

Don’t be one of the “average” Americans who only has $95,776 saved for retirement. Most couldn’t live for a year or two on that money! (Source: Economic Policy Institute)

By the way, have you heard of cryptocurrency yet? Here are a few simple ways to get started with crypto.

Here are the systems that you need to get started with automated investing today:

- Open a savings account at a bank & automate weekly transfers. Make sure that your monthly fees aren’t too high and earning a little interest is great. Having the account at a separate bank than your main account is smart so you don’t get the urge to transfer money over whenever you feel like it.

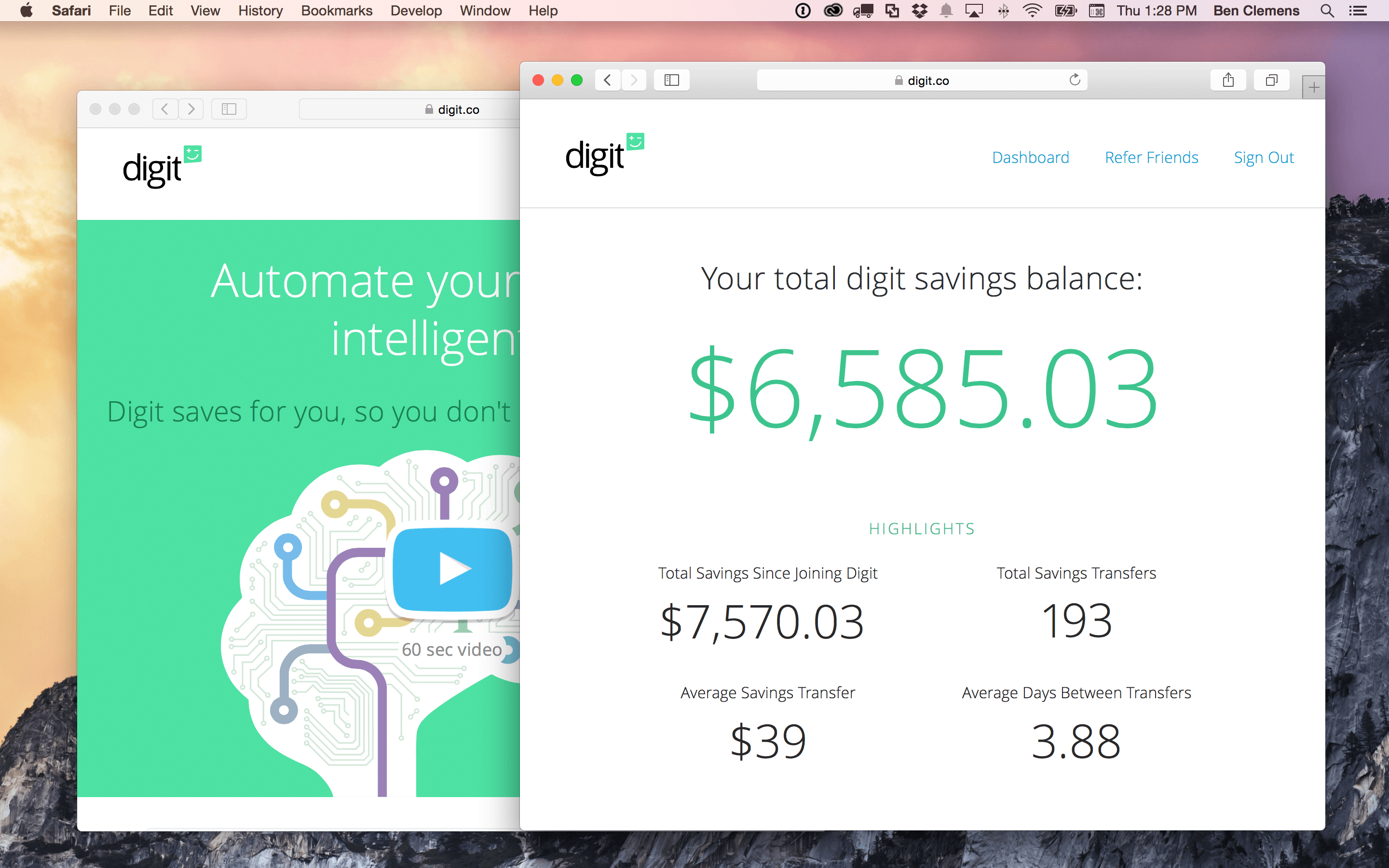

- Download Digit: This is an app that syncs up with your bank account and sneakily saves money for you on a daily basis. It figures out a small amount to save based on the money coming in and going out of your bank account. This makes it so you won’t “feel” the money being saved. It’s kind of like buying a coffee every day, but that coffee can actually turn into gold bars for you one day!

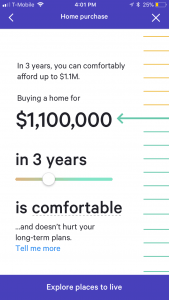

- Sign up with Wealthfront: This is the lowest fee and simplest investment account/app for retirement accounts or other investment accounts. Simply sync this with your bank account and you’ll be leveraging compound interest in no time! It even has a VERY cool projection chart showing how much money you’ll have in the future and plan a date for “retirement”.

By the way, you can also learn more about money making apps in this guide.

Here's how to use these tools when getting started in automated investing:

- Automated investing with a savings account. Step 1 is to set up a savings account and start transferring a consistent weekly amount to it from your main checking. For example, I started off by transferring $100 every Friday. At the end of the year, this amounts to $5,200. The purpose of this account is to use it for taxes and any other unforeseen expenses that come your way. Try your best not to tap into this account if things in your main account get tight… it’s tempting! This can also be an account to help pay down any credit card debt that could be killing you with interest.

- Using Digit for automated investing. You should, at a minimum, set up a Digit account for your business. To take it a step further, sign up for a separate Digit account for your personal account and double save! Sync this app with your account and it will start saving money for you automatically. This account can be used for taxes and unexpected expenses, but I like to use this account for paying me a bonus or buying something sweet – like a drone! for the business. You can actually tell it to save money for a specific thing – like your car payment. It’s pretty amazing to look into the account and see a few grand sitting in there and you never realized that you were saving it. Rather than splurging a bit with this savings, you can use some of this money to max out your retirement accounts like my wife recently did.

- How to use Wealthfront for automated investing: This single system has been the biggest game-changer. This app/account makes it SO very easy to set up weekly transfers from your bank account to fund your future. You can use Wealthfront as a normal investment account or as a

retirement account (ROTH IRAs or other IRAs). This is a great way to not only bring your tax burden down but leverage compound interest. I make sure to max out my IRA every year, which for 2017, the annual maximum contribution for an IRA is $5,500. To ensure you max it out with ease, just set up a weekly transfer of $105.77 and don’t touch it. You’ll be able to watch their nifty graph in their app showing your deposits, how your money is being invested (you choose your risk tolerance and you invest in index funds), and you’ll be able to project your wealth in the future. I’m in my early 30s, so I have a lot of time to invest. Because of this, I maxed out my risk. If you’re a little older, you can be a bit more conservative with your risk level. Either way, this the best way to start investing and building systems around your future wealth.

The first is very thick with solid investment advice and education, the second is a slimmer and more actionable version of the first book (and brand new), and the other is about mindset and growing a wealth mentality.

For some additional reading on automated investing and setting your future self for financial success, check out the following books:

- Money: Master the Game by Tony Robbins: This book single-handedly made me comfortable with finances and investments.

Before reading this, I was clueless. Now I’m confident in what is a good and bad investment and know who I should work with to help me keep building wealth.

- Unshakeable: Your Financial Freedom Playbook by Tony Robbins: This is a brand new book that was just released.

If you’re looking to save some time and just jump straight in, I’d suggest getting this book instead of the first. It’ll give you a quicker roadmap of investing smartly and easily. If you want the more in-depth explanations, definitely get this and the book above (my recommendation).

- The Trick to Money Is Having Some by Stuart Wilde: This book is the single-most dog-eared and highlighted book that Matt has ever read.

He reads it each year as a reminder to keep his mind strong when it comes to wealth. I recently read this and it’s been mind-blowing. It’s all about showing you that wealth and money are everywhere. With this mindset, you’ll grow your income much quicker and always feel secure.

That’s about it!

It’s not rocket science, but the trick is to just get started ASAP and keep it consistent.

After a few months, this will become a habit and you’ll soon be amazed that you’ll have more saved and invested than you ever have before thanks to being proactive and the automated investing systems you've put into place.

Ready to dive more into investing in crypto? Here's how to earn free crypto by blogging.https://digit.co/

Resources mentioned for automated investing:

- Digit

- Wealthfront

- Money: Master the Game by Tony Robbins

- Unshakeable: Your Financial Freedom Playbook by Tony Robbins

- The Trick to Money Is Having Some by Stuart Wilde

- Money making phone apps

- How to get started investing in crypto

- How to earn free crypto by blogging

retirement account (ROTH IRAs or other IRAs). This is a great way to not only bring your tax burden down but leverage compound interest. I make sure to max out my IRA every year, which for 2017, the annual maximum contribution for an IRA is $5,500. To ensure you max it out with ease, just set up a weekly transfer of $105.77 and don’t touch it. You’ll be able to watch their nifty graph in their app showing your deposits, how your money is being invested (you choose your risk tolerance and you invest in index funds), and you’ll be able to project your wealth in the future. I’m in my early 30s, so I have a lot of time to invest. Because of this, I maxed out my risk. If you’re a little older, you can be a bit more conservative with your risk level. Either way, this the best way to start investing and building systems around your future wealth.

retirement account (ROTH IRAs or other IRAs). This is a great way to not only bring your tax burden down but leverage compound interest. I make sure to max out my IRA every year, which for 2017, the annual maximum contribution for an IRA is $5,500. To ensure you max it out with ease, just set up a weekly transfer of $105.77 and don’t touch it. You’ll be able to watch their nifty graph in their app showing your deposits, how your money is being invested (you choose your risk tolerance and you invest in index funds), and you’ll be able to project your wealth in the future. I’m in my early 30s, so I have a lot of time to invest. Because of this, I maxed out my risk. If you’re a little older, you can be a bit more conservative with your risk level. Either way, this the best way to start investing and building systems around your future wealth.