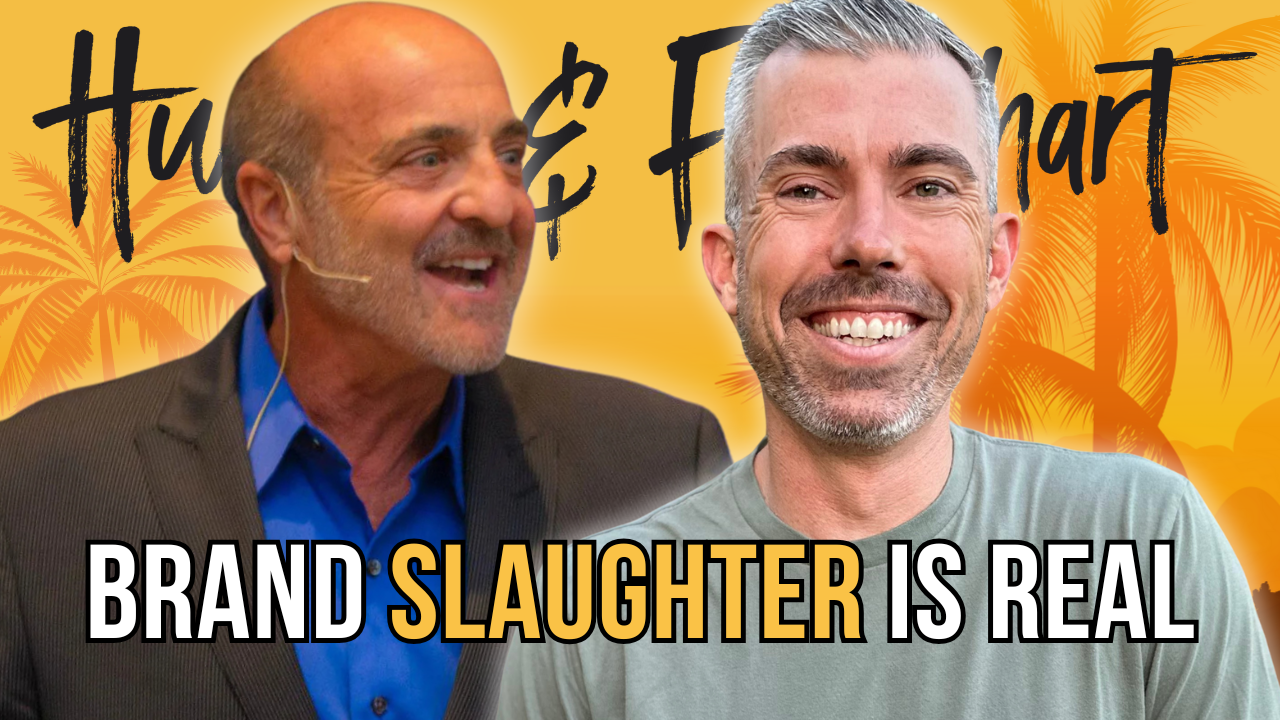

We're back and in this episode, Dave Wolcott shares the significance of having a mindset that promotes holistic wealth, exploring both mental and financial health. Dave also talks about strategic investment tactics to reduce tax burdens and build passive incomes. His background and career journey add valuable context to his strategies, making them relatable and actionable for our listeners.

Table of Contents

ToggleDave Wolcott’s Morning and Evening Routines

Dave advises having an automatic pilot-like morning routine that includes exercise, meditation, and journaling. He strongly encourages investing in oneself, particularly in health, mindset, and financial IQ. According to Dave, consistent habits help in focusing and achieving life goals effectively.

Dave says, “Over time, I understood that health and fitness are two distinct things. Now, at 54, I focus more on health than ever before.”

He also highlights his precise evening routine, which includes foam rolling and stretching to enhance the parasympathetic nervous system and improve sleep quality. He states that a good evening routine is crucial for better sleep and overall well-being.

Mindset and Financial IQ

Dave discusses the importance of overcoming limiting beliefs and making educated decisions regarding financial investments. His book outlines five phases, starting with mindset. He says, “Your net worth is directly proportional to your financial IQ.” This means understanding how money works and making smart financial decisions can significantly impact your wealth.

Dave’s Philosophy on Wealth

Dave's approach to wealth is unique, emphasizing a combination of holistic aspects. Financial freedom goes beyond monetary wealth to include the freedom of purpose, time, and relationships. Dave points out the multiple forms of capital the ultra-wealthy understand: financial, intellectual, physical, emotional, and spiritual.

Career Shift and Wealth-Building Strategies

Dave shares his journey from a middle-class upbringing in Connecticut to joining the Marine Corps. His dissatisfaction with traditional financial advice led him to seek alternative wealth-building strategies. He founded Pantheon to assist others in building wealth outside traditional methods like stocks and bonds.

Entrepreneurial Tax Strategies

Dave dives into various tax strategies and the benefits of investing in oil and gas funds, which offer significant tax deductions. He emphasizes the importance of finding the right CPA for tax planning rather than just tax preparation. Using cash whole life insurance policies, he explains how to leverage capital effectively.

Virtual Family Office Solutions

Dave realized the gap in finding knowledgeable advisors and created a virtual family office offering curated, best-in-breed advisors. This solution aims to reduce taxes, increase wealth, and provide risk management for high-net-worth individuals. According to Dave, even those with a net worth of $3-4 million can significantly benefit from such a resource.

Critique of Traditional Financial Systems

Dave criticizes traditional financial systems like 401ks and IRAs for their lack of control and potential future tax burdens. He shares how he exited his 401k, paid penalties, and reinvested in real estate and energy, resulting in significant growth. Dave’s 401k exit calculator illustrates how reinvesting can outperform traditional returns over 20 years.

Personal Vision and Consistency

Dave emphasizes the importance of creating a personal vision, similar to a business vision statement. He advises entrepreneurs to align their personal and family goals, ensuring better decision-making. Consistent daily habits, including exercise and personal development, contribute to maintaining calmness and effectiveness amidst numerous responsibilities.

External Resources

Conclusion

Dave Wolcott offers a treasure trove of practical advice that redefines financial and personal development. From daily routines to tax strategies and beyond, his insights aim to provide holistic wealth and well-being. If you’re looking to improve not just your financial IQ, but your overall approach to life, this episode is a must-listen.

Thanks for tuning in! Stay curious, stay healthy, and keep hustling.

Two Other Episodes You Should Check Out

Resources From Episode

- What if you could have a FREE personal mentor on-demand?! With Joe's Hustle & Flowchart AI clone, you can tap into the knowledge from over 600 episodes any time! Whether you need advice on scaling, marketing, or productivity, my AI clone is here to help.

- Accelerate growth with HubSpot's Sales Hub

- Check out other podcasts on the HubSpot Podcast Network

- Grab a 30-Day Trial of Kartra

- We want to hear from you. Send us the One Thing you want to hear on the show.

- Connect with Joe on LinkedIn and Instagram

- Subscribe to the YouTube Channel

- Contact Joe: joe@hustleandflowchart.com

Thanks for tuning into this episode of the Hustle & Flowchart Podcast!

If the information in these conversations and interviews have helped you in your business journey, please head over to iTunes (or wherever you listen), subscribe to the show, and leave me an honest review.

Your reviews and feedback will not only help me continue to deliver great, helpful content, but it will also help me reach even more amazing entrepreneurs just like you!