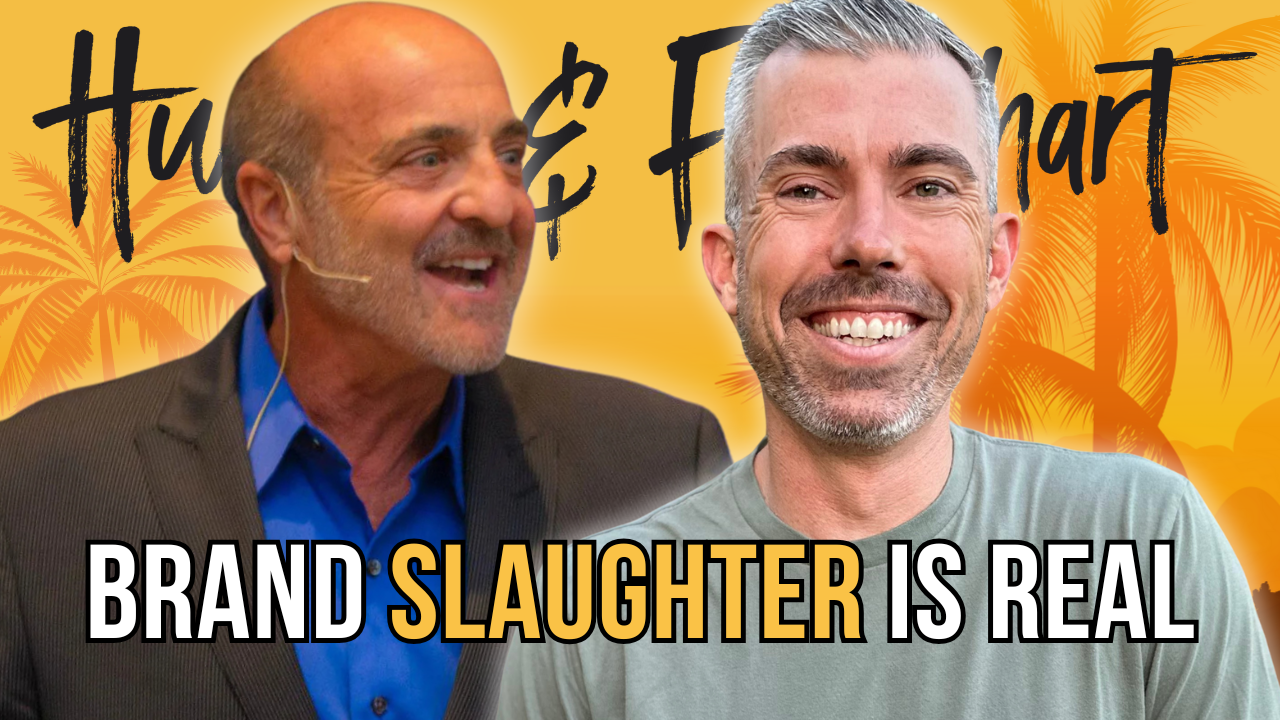

Happy New Year! I'm incredibly excited for you to hear this latest episode with Andy Tanner. Andy is known for his unique insights into investments and financial education. In this episode, we explored many valuable topics, from the origins of the 401k to the importance of financial education for families and the role of asset ownership in today’s technological world. Andy also shared his personal journey, including his and his wife’s survivorship over cancer, which has deeply influenced his approach to life and teaching.

Table of Contents

ToggleIntroduction to Andy Tanner and His Work

Andy Tanner, a well-respected author and financial educator, recently updated his book “Form of Chaos.” He is also known for his association with the Rich Dad, Poor Dad team, having spent 14 years traveling and learning with them. Andy’s insights are shaped by his extensive experience in financial markets and education.

The History and Evolution of the 401k

The 401k began not as a planned retirement strategy but as a loophole for wealthy executives to defer income. Richard Stanger wrote the original 800-word section, spurred by lobbying from companies like Kodak and Xerox through Congressman Barbara Conable. Initially, the financial impact of 401ks seemed minimal, but today, they account for $11 trillion. Andy highlighted that Congressman Conable was unaware of the significance of the 401k when it was enacted. Consultant Ted Benna later capitalized on the 401k for employee bonuses, which led to employer matching and the shift from pensions to 401k plans.

Critique of 401ks and Wall Street

Andy criticized 401ks as favoring Wall Street due to the compounding costs that benefit the financial industry more than the participants. He urged listeners to examine the real value of their 401k plans and warned of hidden drawbacks. Financial education and understanding are crucial to make informed decisions rather than relying blindly on such systems.

Personal Background and Family Life

Andy shared his personal journey, including a significant experience when his wife was diagnosed with breast cancer three years ago. Thankfully, they are doing well now, and this period kept Andy at home more, focusing on teaching from his home studio and spending time with his family. Both he and his wife are cancer survivors, influencing their decision to start a family later in life.

Financial Education for Kids

Andy believes in integrating financial education into family life. His children have benefited significantly from being homeschooled, especially during COVID. This homeschooling emphasized vital financial skills from a young age. Andy uses practical experiences and games like the “Cashflow” game to teach his kids about financial concepts.

Investment Philosophy

Andy advocates for business owners to leverage their profits by investing in assets to expand ownership. Owning assets is crucial in a world increasingly dominated by technology and AI. Andy recommends benefiting from AI advancements by owning stocks in various sectors beyond just tech. He values operational cash flow over mere price speculation, aligning with Warren Buffett’s investment principles. True compounding requires reinvesting profits, similar to business and real estate ventures. Andy views stocks as ownership in a business, stressing the importance of sustainable growth.

Real-World Exposure and Financial Activities with Family

Andy involves his children in financial activities from a young age. He shared how real-world exposure, like bringing his kids to real estate dealings and letting them invest small amounts in family ventures, helps them understand ownership. Andy talked about the concept of “sponsorship equity,” stressing the role of financial education and involvement in tangible activities like stock trading and buying tangible assets like silver.

The Role of AI in Investing

Joe mentioned using AI tools like ChatGPT to distill information and facilitate learning. Andy expressed skepticism about current AI capabilities in trading, pointing out its limitations and inaccuracies. He believes AI is best suited for organizational tasks rather than financial predictions. Andy criticized the culture of overly relying on financial advice rather than self-education, noting that Wall Street benefits from people’s lack of know-how.

Four Key Pillars of Financial Education

Andy outlined four key pillars of financial education essential for investing: fundamental analysis, technical analysis, cash flow, and risk management. Understanding these pillars is vital for managing risk. He recommended “The Intelligent Investor” by Benjamin Graham for insights on investor temperament and fundamentals like earnings and growth.

Risk Management in Business and Investments

Andy discussed that more control equates to less risk, reflecting on Robert Kiyosaki’s idea that risk is related to control. Having good business systems, like standard operating procedures, legal frameworks, and strong communication, helps reduce risk. Leadership and having a mission and a competent team are also crucial. As an investor, understanding earnings and growth serves as KPIs, which are critical for scaling operations.

Concluding Thoughts

This episode with Andy Tanner was packed with valuable insights on financial education, investment strategies, and the importance of ownership. Andy emphasized the significance of learning through experience and being actively involved in financial decisions. He also highlighted the need to educate ourselves rather than relying solely on financial advisors. Understanding the 401k's history and its evolution provides a great perspective on how our financial landscape has changed. Finally, implementing good risk management practices and focusing on ownership can help secure a stable financial future.

Useful Links:

- The Cashflow Academy

- Grab Andy's Book 401(k)aos

- See the latest from Andy on his website

- The Intelligent Investor by Benjamin Graham

Two Other Episodes You Should Check Out

- The Wealth Hacker: Unlocking Financial Freedom with Dave Wolcott

- M.C. Laubscher: Become Your Own Bank?!

Connect with Joe Fier

- What if you could have a FREE personal mentor on-demand?! With Joe's Hustle & Flowchart AI clone, you can tap into the knowledge from over 600 episodes any time! Whether you need advice on scaling, marketing, or productivity, my AI clone is here to help.

- Want us to build your clone for you? We’ll handle setup, testing, and integration so you can launch fast. Head to HustleandFlowchart.com/interest to get started!

- Hubspot has launched a whole new suite of AI Tools, check them on the Hubspot.com

- Check out other podcasts on the HubSpot Podcast Network

- We want to hear from you. Send us the One Thing you want to hear on the show.

- Connect with Joe on LinkedIn and Instagram

- Subscribe to the YouTube Channel

- Contact Joe: joe@hustleandflowchart.com

Thanks for tuning into this episode of the Hustle & Flowchart Podcast!

If the information in these conversations and interviews have helped you in your business journey, please head over to iTunes (or wherever you listen), subscribe to the show, and leave me an honest review.

Your reviews and feedback will not only help me continue to deliver great, helpful content, but it will also help me reach even more amazing entrepreneurs just like you!